How to use this Pay Calculator?

- Enter your salary/wage;

- Choose if that's annual, monthly, fortnightly or weekly amount;

- Select other options if that applies to you; and

- Click "CALCULATE"!

Lost Super

There is $17.5 billion in lost & unclaimed super across Australia. Make sure none of it is yours!

Pay Calculator:

- Try our other calculators:

- GST Calculator (or new one)

- Percentage Calculator

- Stamp Duty Calculator

Take Home Pay is Different than your Paycheck?

This pay calculator uses official ATO tax rates to calculate your pay after taxes. Your employer may use ATO tax tables to calculate your taxes and thus you might be getting different amount. Usually you pay more tax this way and that's why you get tax refund from the ATO after you submit the tax return.

For example:

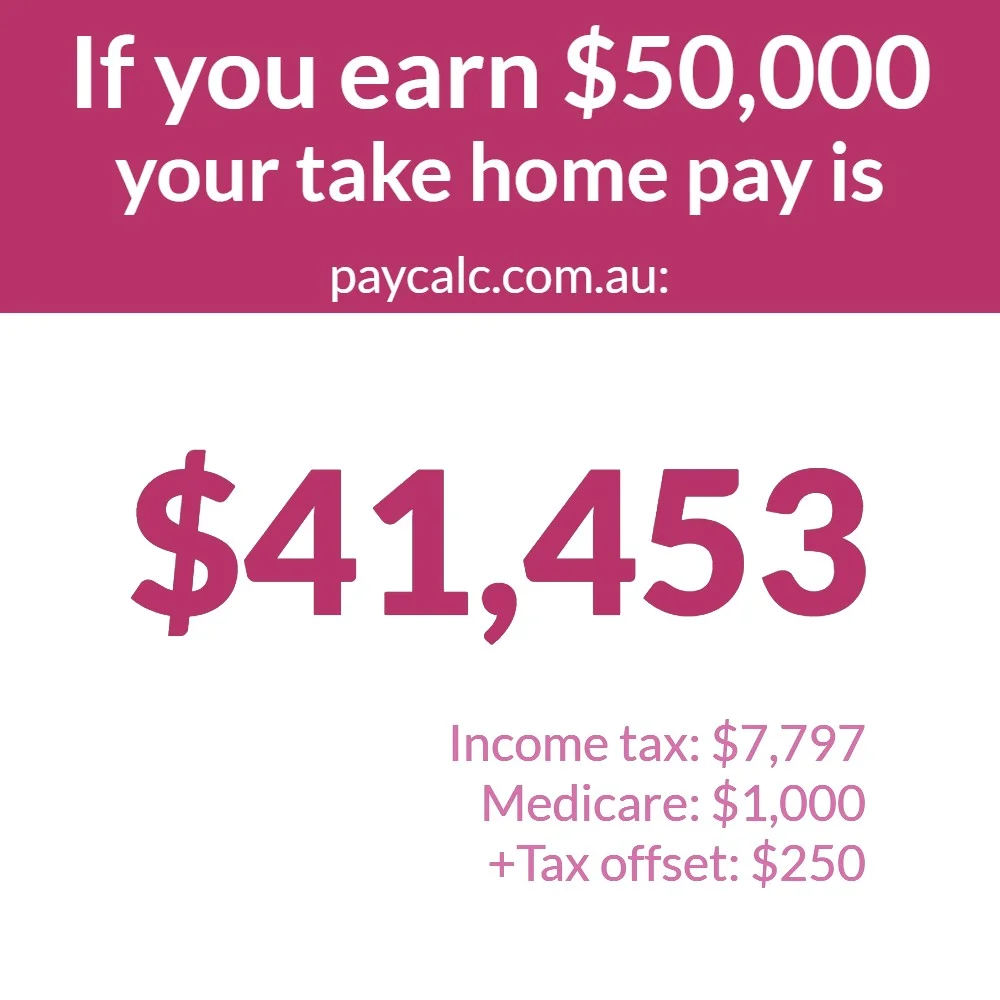

How much do you pay in taxes if you make 50000 a year?

If you make $50,000 in taxable income in Australia, then first $18,200 is not taxed, next $18,800 is taxed at 19%, and the rest $13,000 is taxed at 32.5%. That means you pay a total of $7,797 in income tax, $1,000 in Medicare Levy and get $250 in tax offset. $41,453 is yours to keep. (Source: ATO Tax Rates)

However by using ATO tax tables your employer will deduct $732 per month if salary is paid monthly and in total $8,784 during financial year (12 x $732). The difference is $237 and that's what you are going to get back assuming you had no more income or work related expenses. Below is the table what you could get back based on your pay frequency:

| Pay Frequency | Earnings Per Pay Period | ATO Witholding | Tax Withold Annualy | Tax Refund |

|---|---|---|---|---|

| Weekly | $961 | $169 | $8,788 | $241 |

| Fortnightly | $1,923 | $338 | $8,788 | $241 |

| Monthly | $4,167 | $732 | $8,784 | $237 |

Earning $87000+? How much does your pay increase after 2016 Federal Budget?

2016 Federal Budget proposed to expand the 32.5 cent band from $80,000 to $87,000. That means these extra $7,000 will be taxed at 32.5% rate instead of 37% which will increase your take home pay by $315.

These tax rates are still awaiting parliamentary approval, but it should be approved after the election. If you want to calculate your pay after tax with the factual rates at the moment, please use 2015/2016 year tab on the calculator.

Once again, if your employer uses ATO tax tables to calculate your pay, you will be overpaying $67 in tax if you earn $87,000 per year and getting paid fortnightly:

- ATO fortnightly tax deductions - $844.

- ATO yearly deductions - $21,944 ($844 x 26).

- You should be paying - $21,877.